Financial Modeling

Financial modeling is a core component of evaluating and prioritizing decarbonization investments. While energy and emissions impacts are critical, decision-making often depends on understanding how interventions perform financially over time. This includes not only how quickly an investment pays back, but also how it performs relative to other variables over time, such as replacement and maintenance costs, utility rate changes, and penalties related to building energy performance standards

The Financial Modeling features in Carbon Signal enable users to evaluate the financial performance of decarbonization interventions directly within the platform. By connecting modeled energy savings, emissions reductions, and cost assumptions, Carbon Signal allows users to assess individual interventions and combined packages using standard financial metrics.

Viewing Financial Modeling Analysis

Financial modeling results can be viewed at both the intervention level and the building level from the Building Details page.

Viewing Results at the Intervention Level

For each intervention, Net Present Value and Marginal Abatement Cost can be viewed over different analysis horizons. Users can see these metrics in a 3-year, 10-year, or 15-year timeframe to understand how the financial performance of an intervention changes over time.

Viewing Results at the Building Level

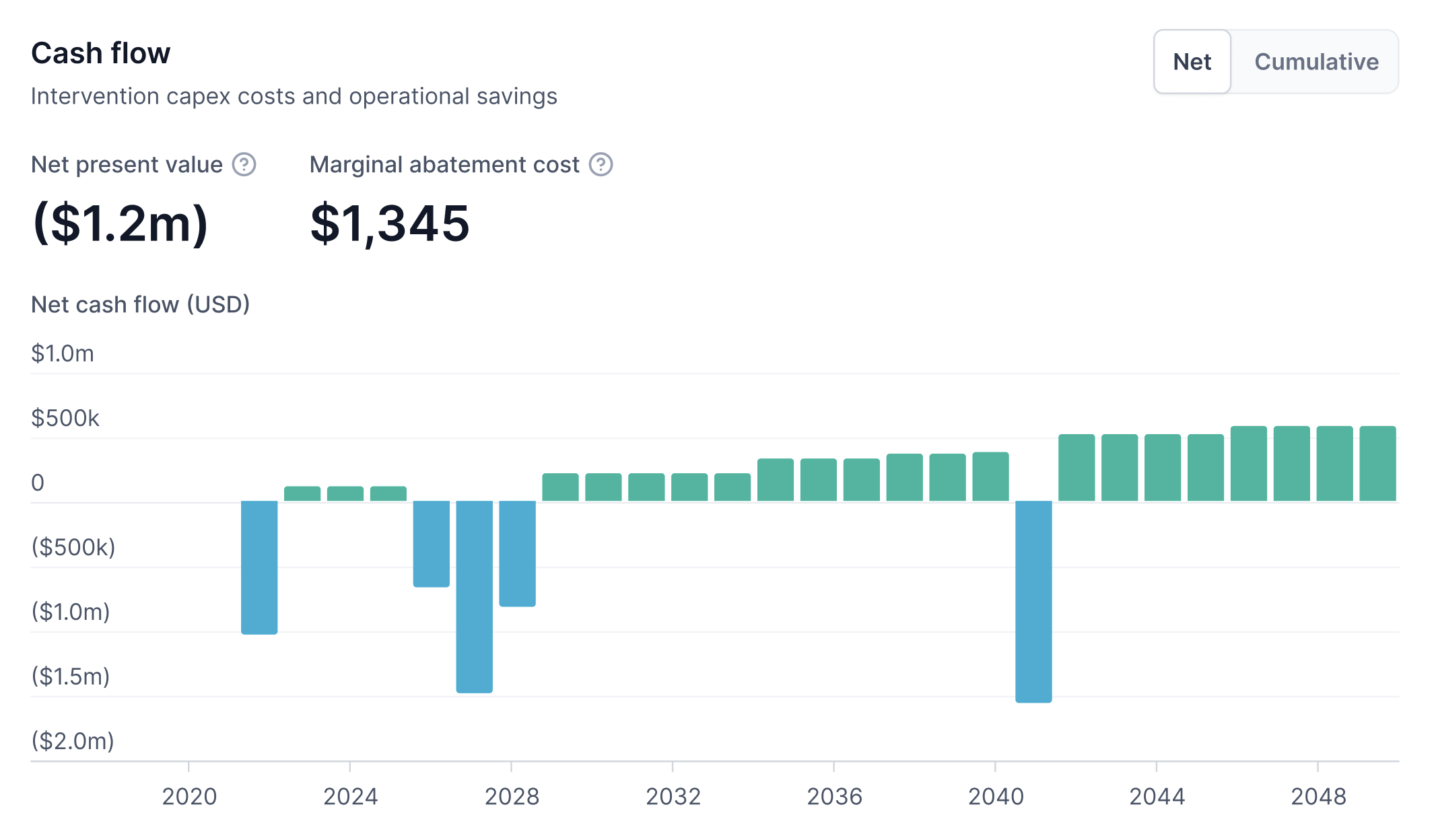

Navigate to the Building Details page for a building. When one or more interventions are applied, Carbon Signal displays a life cycle cost analysis chart showing projected cash flows over time for the building. The overall Net Present Value and Marginal Abatement Cost for the combined set of applied measures are also shown, allowing users to evaluate bundled interventions as a single investment decision.

Adjusting Financial Modeling Inputs

Financial modeling inputs can be adjusted at both the intervention level and the building level. These inputs directly affect calculated financial metrics.

Adjusting Inputs at the Intervention Level

- Navigate to the Building Details page for a building.

- Select the intervention you would like to adjust.

- In the intervention slide panel, adjust the relevant financial inputs, including:

- Capital cost of the intervention

- Any first year utility incentives

- Service life, which determines the replacement year

- Changes in annual maintenance costs, including increases or decreases and the associated dollar amount per year

These inputs are used to calculate intervention-level cash flows and financial metrics.

Adjusting Inputs at the Building Level

- From the Building Details page, navigate to the Building Info tab.

- Specify whether avoided Building Performance Standards penalties should be included in the financial analysis.

- Adjust the cash flow discount rate used for Net Present Value calculations.

Building-level inputs are applied consistently across all interventions and influence the overall financial metrics shown for the building.